How Much is Baird Gold? A Guide to Understanding Prices and Value

Investing in gold is a time-honored strategy for preserving wealth and diversifying an investment portfolio. When it comes to purchasing gold, one of the most trusted names in the market is Baird & Co., a renowned refiner and dealer of precious metals based in the UK. If you’re considering purchasing Baird gold bars, one of the first questions you may ask is, “How much is Baird gold?” The answer depends on several factors, including the weight of the gold, current market prices, and additional costs such as premiums. This article will explore these factors and give you a clear understanding of Baird gold prices.

What is Baird Gold?

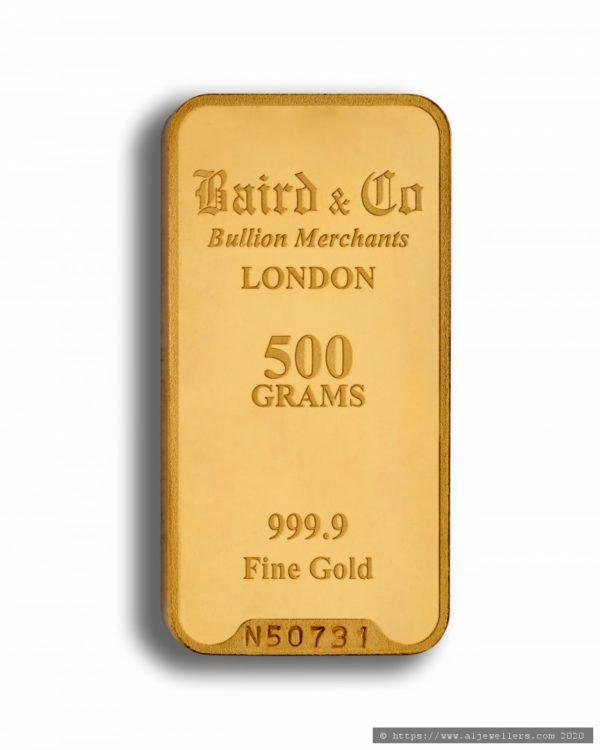

Baird & Co. is a London-based precious metals refiner and dealer established in 1967. The company produces a wide range of investment-grade gold bars that are highly sought after due to their reputation for quality and purity. Baird gold bars are made from 99.99% pure (24-karat) gold, ensuring that investors are receiving the highest quality gold available on the market. They are available in a variety of sizes, ranging from 1 gram to 1 kilogram, making them accessible to all types of investors, whether large or small.

How Much is Baird Gold?

The price of Baird gold bars depends on several factors, including:

1. Spot Price of Gold

The most significant factor determining the price of Baird gold bars is the spot price of gold. The spot price is the current market price for gold, quoted per ounce or per gram, and it fluctuates constantly based on global economic conditions, political events, and market demand.

To determine the base price of a Baird gold bar, you can multiply the current spot price per gram by the weight of the bar. For example, if the spot price is $60 per gram, the base price of a 100-gram Baird gold bar would be:

60×100=6,000 USD60 \times 100 = 6,000 \text{ USD}60×100=6,000 USD2. Premium Over Spot Price

In addition to the spot price, gold bars often come with a premium. The premium is an additional cost that covers refining, manufacturing, distribution, and the dealer’s margin. The premium for Baird gold bars can vary depending on the size of the bar, market conditions, and demand. Smaller bars typically have higher premiums compared to larger bars due to the manufacturing costs involved.

For example, a 1-gram gold bar may have a premium of 5% to baird gold 10%, while a 100-gram or 1-kilogram bar may have a lower premium of around 2% to 4%.

3. Currency Exchange Rates

Since gold is traded in US dollars globally, if you are purchasing Baird gold in a different currency, the exchange rate between your local currency and the US dollar will affect the final price. A favorable exchange rate can make the gold bar cheaper, while a weaker local currency may increase the cost.

4. Size and Weight of the Gold Bar

Baird gold bars come in various weights, and the price will vary based on the size of the bar. Smaller bars such as the 1g, 5g, or 10g bars are more affordable for small-scale investors but tend to have higher premiums. Larger bars, such as the 100g, 250g, or 1kg bars, offer better value in terms of premium costs.

Here are some popular sizes of Baird gold bars and examples of their prices based on a spot price of $60 per gram:

- 1g Baird Gold Bar: $60 (plus premium)

- 10g Baird Gold Bar: $600 (plus premium)

- 100g Baird Gold Bar: $6,000 (plus premium)

- 250g Baird Gold Bar: $15,000 (plus premium)

- 1kg Baird Gold Bar: $60,000 (plus premium)

5. Taxes and Duties

Depending on your location, the price of Baird gold may also be subject to taxes or import duties. In many countries, investment-grade gold (with a purity of 99.5% or higher) is exempt from Value-Added Tax (VAT), but it’s essential to check your local tax laws to avoid any unexpected costs.

How to Calculate the Price of Baird Gold

If you want to calculate the price of a Baird gold bar, follow these steps:

-

Check the Current Spot Price: The spot price of gold is updated in real-time across global markets. You can find the current spot price on financial news websites, bullion dealer platforms, or gold market apps.

-

Multiply by the Weight of the Bar: Multiply the spot price per gram by the weight of the Baird gold bar you’re interested in purchasing. This will give you the base price.

-

Add the Premium: Factor in the premium charged by the dealer. For smaller bars, this can range from 5% to 10%, while larger bars may have premiums as low as 2%.

-

Consider Additional Costs: Don’t forget to include any taxes, shipping, or insurance costs that may apply.

For example, let’s calculate the price of a 100g Baird gold bar if the spot price is $60 per gram, and the premium is 3%:

- Base Price: $60 x 100 = $6,000

- Premium: $6,000 x 1.03 = $6,180

- Final Price: $6,180 (before taxes and shipping)

Why Choose Baird Gold Bars?

There are several reasons why investors choose Baird gold bars as part of their portfolio:

1. Reputation and Trust

Baird & Co. is a trusted name in the precious metals industry, known for its high-quality gold bars and long-standing reputation. When you buy Baird gold, you are investing in a product that is recognized globally for its purity and quality.

2. Purity

Baird gold bars are refined to a purity of 99.99%, ensuring that you are purchasing investment-grade gold. This high level of purity is ideal for investors looking to protect their wealth with a tangible and reliable asset.

3. Variety of Sizes

Whether you’re a small investor or someone looking to make baird gold a substantial investment, Baird offers a wide range of gold bar sizes to suit every need. From 1g to 1kg, you can choose a bar that fits your budget and investment goals.

4. Easy Liquidity

Gold bars, especially those from well-known refiners like Baird, are highly liquid. This means they can be easily bought or sold in global markets, providing flexibility for investors who may need to access funds quickly.

Conclusion

So, how much is Baird gold? The price depends on several factors, including the current spot price of gold, the size of the bar, the premium over the spot price, and local taxes or duties. By keeping an eye on the spot price, calculating the premium, and working with reputable dealers, investors can make informed decisions and add high-quality Baird gold bars to their portfolios. Whether you’re looking for a small 1g bar or a large 1kg bar, Baird gold offers a reliable and secure way to invest in precious metals

- Business

- Art & Design

- Technology

- Marketing

- Fashion

- Wellness

- News

- Health & Fitness

- Food

- Jogos

- Sports

- Film

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- DIY & Crafts

- Theater

- Drinks