Can the Faster Payment Service Market Really Revolutionize world' s Digital Transactions

Introduction

The Faster Payment Service (FPS) Market has emerged as a transformative segment in the global financial ecosystem. FPS enables instant money transfers between banks and financial institutions, ensuring faster and seamless transactions for consumers and businesses alike. With the growing demand for real-time payments and digital banking, FPS has become a critical component of modern financial infrastructure.

In recent years, the market has witnessed significant growth due to technological advancements, increased adoption of digital wallets, and government initiatives promoting cashless transactions. The market’s contribution to enhancing operational efficiency, reducing transaction times, and improving customer satisfaction underscores its importance in the global economy.

Stay ahead with crucial trends and expert analysis in the latest Faster Payment Service (FPS) Market report. Download now: https://www.databridgemarketresearch.com/reports/global-faster-payment-service-fps-market

Market Overview

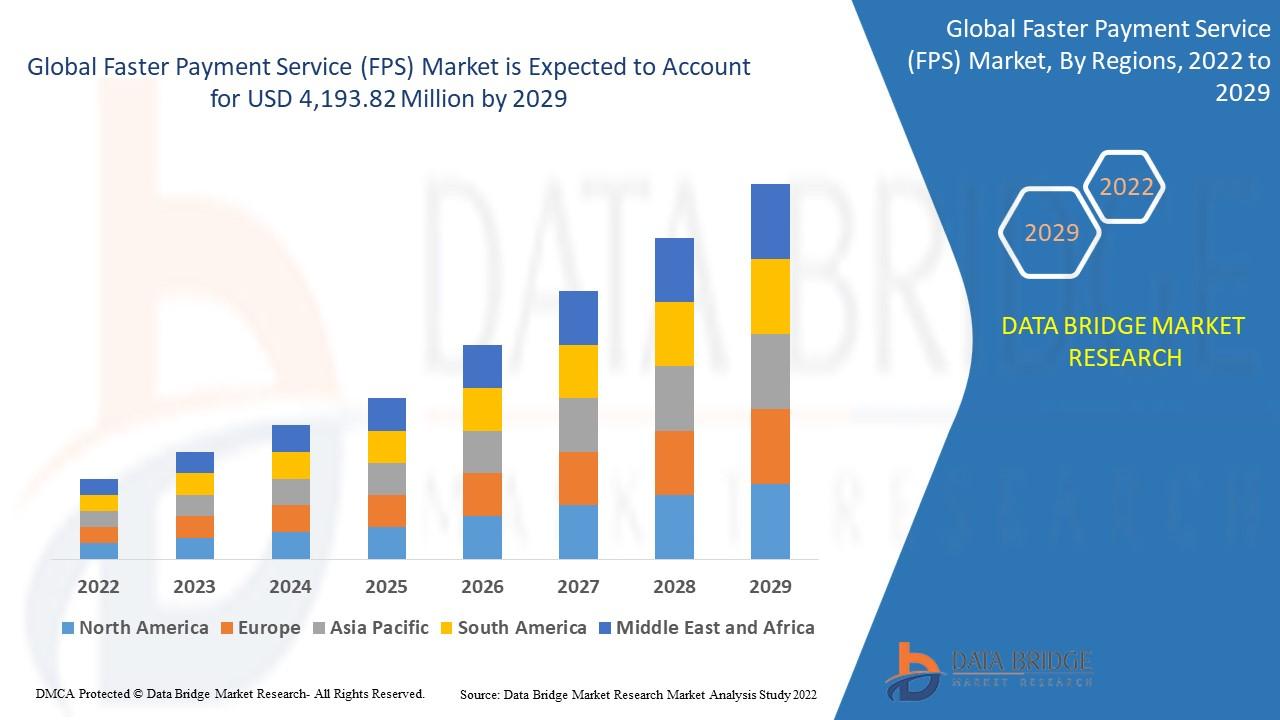

The Faster Payment Service Market has experienced substantial expansion over the past decade. In 2024, the global market size was estimated at approximately USD 5.2 billion, and it is expected to reach USD 12.7 billion by 2030, growing at a compound annual growth rate (CAGR) of 15.8% during the forecast period.

Key regions driving this growth include North America, Europe, and Asia-Pacific. North America remains a leader due to high adoption rates of digital banking solutions and advanced financial infrastructure. Europe is also witnessing robust growth, fueled by strong regulatory support and initiatives like the European Payments Council’s SEPA Instant Credit Transfer. Meanwhile, Asia-Pacific is emerging as a fast-growing market, with countries such as China, India, and Singapore investing heavily in real-time payment platforms.

Key Market Drivers

Several factors are propelling the growth of the Faster Payment Service Market:

-

Technological Advancements: The adoption of artificial intelligence, blockchain, and cloud computing in payment systems has enhanced security, reduced processing times, and minimized errors.

-

Rising Demand for Real-Time Payments: Consumers and businesses increasingly prefer instant transactions over traditional methods, boosting the adoption of FPS.

-

Government Initiatives: Regulatory support from governments worldwide is encouraging digital transactions. Programs promoting cashless economies, such as India’s UPI or the UK’s Faster Payments Scheme, are key growth drivers.

-

Digital Banking Expansion: The proliferation of mobile banking apps and digital wallets has made instant money transfers accessible to a broader audience.

Market Segmentation

The FPS Market can be segmented based on transaction type, end-user, and region.

-

By Transaction Type:

-

Person-to-Person (P2P): Transfers between individuals using mobile banking apps.

-

Business-to-Business (B2B): Real-time settlements for commercial transactions.

-

Consumer-to-Business (C2B): Payments for goods and services via instant platforms.

-

-

By End-User:

-

Banking & Financial Institutions: Banks deploying FPS to enhance customer services.

-

E-Commerce Platforms: Businesses relying on instant payments to improve cash flow.

-

Retail & Consumer Services: Retailers facilitating quick payments for convenience.

-

-

By Region:

-

North America: Dominated by the U.S., with early adoption and strong regulatory support.

-

Europe: Key players include the U.K., Germany, and France, benefiting from harmonized payment schemes.

-

Asia-Pacific: Fastest-growing region with high smartphone penetration and digital payment adoption.

-

Middle East & Africa: Emerging opportunities in mobile-based payments and fintech solutions.

-

Latin America: Growth driven by digital banking trends and financial inclusion initiatives.

-

Among these segments, P2P transactions and the banking sector remain the most dynamic, reflecting the increasing demand for speed and convenience in financial operations.

Competitive Landscape

The FPS Market is characterized by intense competition among global and regional players. Leading companies include Mastercard, Visa, The Clearing House, PayPal, and FIS Global.

Market players are focusing on strategies such as:

-

Product Innovation: Developing solutions that integrate real-time payments with other banking services.

-

Partnerships: Collaborating with fintech startups to enhance technological capabilities.

-

Mergers & Acquisitions: Acquiring smaller firms to expand market share and strengthen regional presence.

-

Geographical Expansion: Entering emerging markets with high growth potential, particularly in Asia-Pacific and Africa.

Competition drives continuous improvement in service quality, security, and transaction speed, benefiting end-users globally.

Challenges and Restraints

Despite robust growth, the FPS Market faces several challenges:

-

Regulatory Compliance: Variations in regulations across countries can hinder seamless global operations.

-

Cybersecurity Risks: The rise of digital payments increases vulnerability to fraud and hacking incidents.

-

High Infrastructure Costs: Setting up and maintaining real-time payment systems requires significant investment.

-

Limited Awareness in Emerging Markets: In certain regions, lack of digital literacy slows adoption.

Addressing these challenges requires coordinated efforts among financial institutions, governments, and technology providers.

Future Outlook

The Faster Payment Service Market is expected to maintain strong growth in the coming years. Key trends shaping the future include:

-

Integration with AI and Machine Learning: Enhancing fraud detection, transaction routing, and customer support.

-

Blockchain Adoption: Improving transparency and reducing settlement times across cross-border payments.

-

Open Banking Initiatives: Encouraging third-party providers to offer innovative payment solutions.

-

Expansion into Underserved Markets: Emerging economies present vast opportunities for digital payment adoption.

As consumer preferences continue to shift towards instant payments, FPS will play a pivotal role in redefining the global financial landscape.

Conclusion

The Faster Payment Service Market has emerged as a cornerstone of modern banking and digital transactions. Fueled by technological innovation, regulatory support, and growing consumer demand, the market is poised for sustained growth. While challenges such as cybersecurity and high infrastructure costs exist, ongoing advancements and strategic initiatives from market players are likely to overcome these barriers.

In conclusion, FPS not only enhances transaction efficiency but also drives financial inclusion and economic growth. The market’s trajectory indicates a future where real-time payments become the global standard, creating opportunities for businesses, banks, and consumers alike.

Frequently Asked Questions (FAQs)

1. What is the growth rate of the Faster Payment Service Market?

The market is projected to grow at a CAGR of 15.8% between 2025 and 2030, reflecting strong adoption of real-time payment systems globally.

2. Which region is expected to dominate the FPS Market in the future?

North America currently leads, but Asia-Pacific is expected to be the fastest-growing region due to digital payment adoption and government initiatives promoting cashless economies.

3. Who are the leading players in the FPS Market?

Key companies include Mastercard, Visa, The Clearing House, PayPal, and FIS Global, focusing on product innovation, partnerships, and geographical expansion.

4. What are the major challenges faced by the FPS Market?

The market faces challenges such as regulatory compliance, cybersecurity risks, high infrastructure costs, and limited awareness in certain emerging markets.

5. What are the future opportunities in the FPS Market?

Opportunities include integrating AI and blockchain, expanding into underserved regions, and leveraging open banking initiatives to create innovative payment solutions.

Browse More Reports:

U.S. Bulletproof Glass Market

Asia-Pacific Bullet Proof Glass Market

Europe Bullet Proof Glass Market

Middle East and Africa Bullet Proof Glass Market

North America Bullet Proof Glass Market

U.S. Bullet-Proof Glass Market

Asia-Pacific Business Process as a Service (BPaaS) Market

North America Business Process as a Service (BPaaS) Market

Asia-Pacific Cannabis Market

Middle East and Africa Cannabis Market

North America Cannabis Market

Southeast Asia Dispensing Caps and Closures Market

Europe Central Precocious Puberty (CPP) Treatment Market

Asia-Pacific Central Precocious Puberty (CPP) Treatment Market

North America Central Precocious Puberty (CPP) Treatment Market

Middle East and Africa Central Precocious Puberty (CPP) Treatment Market

Europe Cold Sore Treatment Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [email protected]

- Business

- Art & Design

- Technology

- Marketing

- Fashion

- Wellness

- News

- Health & Fitness

- Food

- Games

- Sports

- Film

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- DIY & Crafts

- Theater

- Drinks